Vietnam presents significant growth opportunities for businesses expanding in Asia, yet its regulatory environment is notably complex. Companies operating there must navigate strict local tax and accounting laws, detailed statutory reporting requirements, and electronic invoicing regulations that go beyond what standard ERP systems typically cover.

Fill the form to download this whitepaper

Challenges of Compliance in Vietnam

Businesses in Vietnam must comply with the Ministry of Finance’s Circular 200/2014/TT-BTC, which governs VAT, Corporate Income Tax (CIT), Personal Income Tax (PIT), and audit requirements. Financial reports such as balance sheets, profit and loss statements, and tax declarations must be prepared in exact formats, often requiring bilingual Vietnamese-English versions. Additionally, the General Department of Taxation mandates the use of RED VAT electronic invoices, with specific rules for issuing, adjusting, cancelling, or replacing invoices.

Vietnamese Localization Solutions for Dynamics 365

Yokogawa Votiva Solutions offers a Vietnamese Localization Solutions package designed to extend Microsoft Dynamics 365 to meet these local statutory requirements seamlessly.

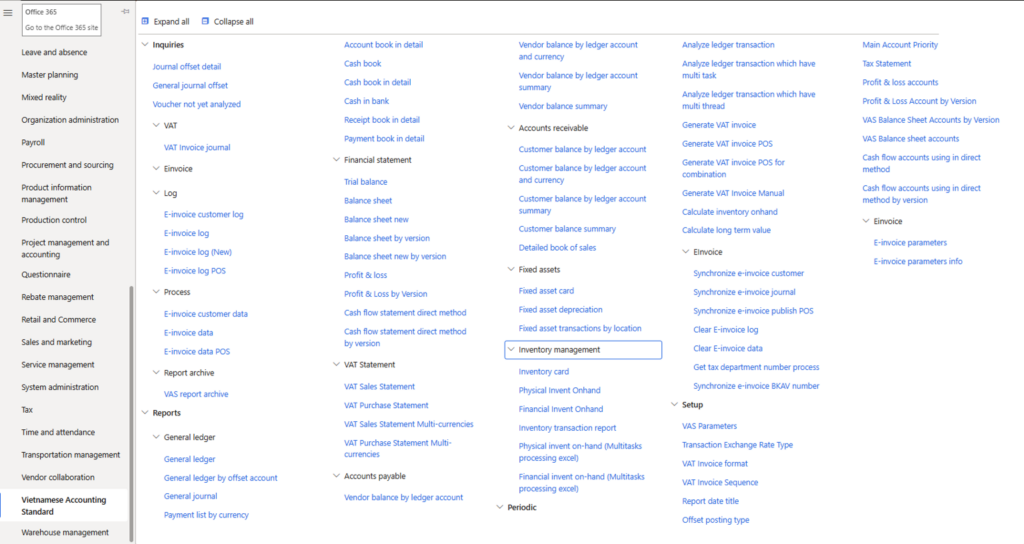

Vietnamese Accounting Standard (VAS) Package

- Fully compliant with Circular 200/2014/TT-BTC and Vietnam’s accounting principles.

- Generates over 30 mandatory financial and statutory reports, ensuring audit readiness.

- Supports bilingual Vietnamese-English reporting to facilitate communication with auditors and regulators.

- Automates month-end and year-end closing processes with offset posting for accurate revenue and expense reflection

Benefits of Using Vietnamese Localization Solutions

- Automation and Accuracy: Eliminates reliance on spreadsheets and disconnected local workarounds, reducing manual effort and minimizing errors in tax filings, statutory reports, and e-invoicing.

- Audit Preparedness: Maintains financial statements in line with local regulations to ensure readiness for audits without last-minute adjustments.

- Focus on Growth: Frees finance teams from routine compliance tasks, allowing them to concentrate on strategic initiatives.

- Microsoft Certified: The localization is certified for Dynamics 365, guaranteeing smooth upgrades and long-term support.

Conclusion: Simplifying Growth in Vietnam

Yokogawa Votiva Solutions helps businesses overcome the complexities of Vietnam’s tax, accounting. By simplifying compliance processes with specialized localization for Dynamics 365, companies can remain audit-ready and focus on expanding their operations in this dynamic market.

Another localization solutions