Vietnam’s rapidly expanding market presents significant opportunities for businesses, but navigating its stringent tax regulations, especially the mandatory electronic invoicing, poses considerable challenges. The YVS Vietnamese E-invoice Solution offers a comprehensive solution to ensure compliance with Vietnam’s laws, helping companies streamline operations and focus on growth.

Fill the form to download this whitepaper

Challenges of E-invoice Compliance in Vietnam

Under Decree 119/2018/ND-CP and Circular 68/2019/TT-BTC issued by Vietnam’s General Department of Taxation require all businesses, including household and individual traders, to issue RED VAT e-invoices for sales and services. This obligation extends to various transaction types such as promotions, samples, and employee payments in kind.

Companies must also adhere to strict rules for issuing, adjusting, cancelling, or replacing e-invoices while maintaining accurate, audit-ready records.

Manual management of these requirements increases error risks and diverts resources from strategic activities.

YVS Vietnamese E-invoice Solution

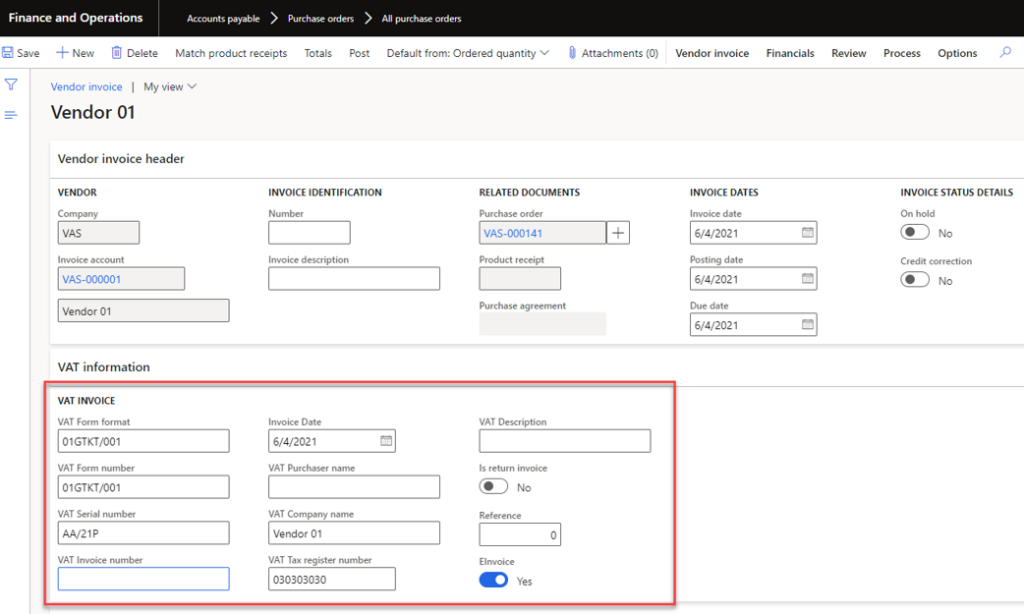

Yokogawa Votiva Solutions has developed this solution that integrates seamlessly with Microsoft Dynamics ERP platforms including Dynamics Axapta, Dynamics 365 Finance & Operations (D365FO), and Business Central (D365BC). This solution enables businesses to:

- Issue, cancel, adjust, and replace RED VAT e-invoices directly within Dynamics 365, fully compliant with Vietnamese tax laws.

- Integrate with major authorized providers such as VNPT, Viettel, and BKAV and more certified partners.

- Manage diverse transaction types including sales orders, purchase orders, free text invoices, project invoices, and internal transfer slips.

- Support multiple business units under a single legal entity, each with distinct VAT serial numbers.

- Automatically synchronize customer master data and invoices to e-invoice portals, reducing manual uploads and ensuring data consistency.

- Handle e-invoice logs, configure account credentials, and automate synchronization via batch jobs for operational control.

Key Benefits for Businesses

- The solution ensures end-to-end compliance with evolving Vietnamese e-invoicing regulations.

- Significantly reducing manual workloads and errors by replacing spreadsheets and local workarounds.

- It supports audit readiness through accurate and standardized processes aligned with statutory requirements.

- By automating compliance complexities, it frees teams to concentrate on business growth.

- The package is certified for Dynamics 365 integration, guaranteeing smooth upgrades and long-term support.

Future-proofing Operations in Vietnam

Businesses expanding in Vietnam can leverage the Vietnam e-invoice module to navigate complex e-invoice regulations efficiently, reduce operational costs, and confidently scale in one of Asia’s most dynamic markets.

Explore more our localization solutions